How Being Prepared and Better Planning Saved the Day Amid Russia-Ukraine War Neon Shortage

The Global Semiconductor Industry and Rare Gas Supply

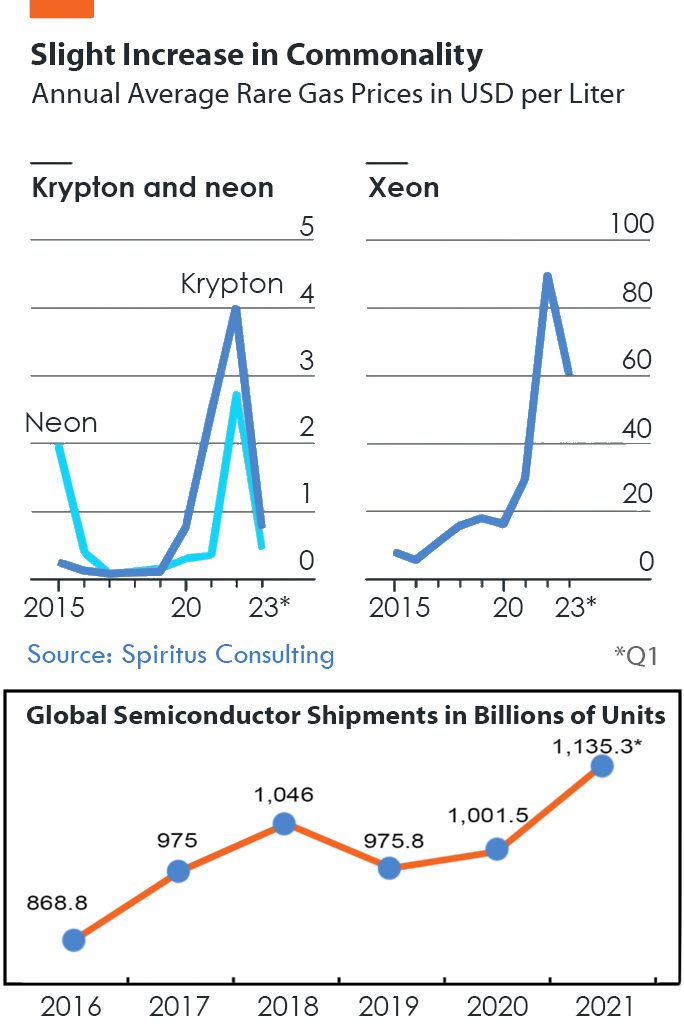

Rare gases—neon, krypton, and xenon—are used in various industries, including semiconductor chipmaking, medicine, and space propulsion. Russia and Ukraine have long been major suppliers, accounting for about 40-50% of the global supply of neon before the conflict, and 25-30% of xenon and krypton, according to John Raquet of Spiritus Consulting, an industrial-gas specialist. Supply of neon from Russia and Ukraine has been as high as 70%. Krypton, neon, and xenon are by-products of air separation, with oxygen being involved in steelmaking. Overcoming the potential neon shortage has been of paramount importance for the semiconductor industry since the onset of the conflict.

Impact of the Russia-Ukraine War on Rare Gas Prices and Supply

The drop in rare gas supply caused a surge in wholesale prices, particularly of xenon, which went from $15 a liter in 2020 to more than $100 in mid-2022. Many forecasters, like Peter Zeihan, were predicting economic disaster, disruption, and shortages from the Russia-Ukraine war. The over $1 trillion semiconductor chip industry would be wrecked from a shortage of neon gas.

Industry Adaptations and Mitigations

Despite the predictions, the prices of rare gases have come back down, and semiconductor supplies remain stable. Chipmakers drew on their rare-gas reserves and invested in technology that enables recycling. Other buyers cut usage or switched to alternatives. Russia still exported gas to China, and China sold its supply to other countries.

Semiconductor chips use excimer laser technology in the deep ultraviolet, with a wavelength of just under 200 nanometers. The excimer lasers used in semiconductor manufacturing use well-known laser gases such as argon and fluorine, with neon as a buffer gas. However, as 5 and 2 nm technology become more commonplace, the need for neon as a laser gas may decrease significantly. The extreme ultraviolet lasers with 13.5 nanometer light do not use neon gas. The EUV process vaporizes tin.

Neon can be made anywhere by distillation of liquid air, but with neon having a mass fraction of one part in 79,000 in the atmosphere, the gas will be expensive. Short-term solutions include Taiwanese major TSMC recycling and purifying spent neon for reuse, and laser makers optimizing operating procedures to reduce the risk of a neon shortage.

Alternatives and Self-Sufficiency in Rare Gas Supply

Xenon is usually used as an anesthetic but can be swapped with nitrous oxide. Different gases, similar to argon or nitrogen, can be used instead of krypton in triple-glazed windows. Krypton and xenon are used as propellant in satellite thrusters. Starlink satellites launched by SpaceX now use argon as an alternative.

Retrofitting air-separation plants with taps that allow rare-gas mixtures to be extracted is expensive and halts production for two or three months. New construction has air-separation taps installed. Russia diverted exports to China, which then had a surplus and exported its supplies. Japan is enhancing domestic production through a mix of retrofitting and new plants. South Korea aims to be self-sufficient in rare gases within two years.

TSMC’s Supply Chain Management and Recycling Initiatives

TSMC is evaluating supply chain risks and has continuity plans for about “the next five years” to ensure it can source more than 2,000 chipmaking materials and chemicals to meet expansion plans. TSMC has helped its suppliers buy materials, chips, and components and tried to coordinate among different suppliers to identify bottlenecks in the supply chain.![]()

TSMC developed the first system for turning liquid waste from used hydrogen fluoride — a chemical used for cleaning wafers — into high-purity cryolite for use in the aluminum industry.

TSMC hopes to eventually turn used hydrogen fluoride back into fluorite, the raw material it is made from. China and Mexico control nearly 70% of global fluorite output. Reclaiming fluorite from hydrogen fluoride would help suppliers use fewer raw materials and significantly reduce carbon emissions.

Lin, a representative from TSMC, said that ideally, all materials will be able to be recycled and used in chipmaking. As of 2021, Taiwan was able to source more than 60% of its indirect materials — including chemicals and gases, but excluding wafers — locally. The figure for the U.S. was 89% and 33% for China.

Neon Shortage Conclusion

The global semiconductor industry managed to overcome the predicted economic disaster and shortages due to the Russia-Ukraine war by adapting their processes, utilizing alternative materials, and investing in recycling technologies. Countries like Japan and South Korea are working towards self-sufficiency in rare gas supply, and major companies like TSMC are taking steps to ensure supply chain continuity and minimize environmental impact.

LogicFortress vigilantly monitors global affairs to assess the impact on the availability of crucial technology products for our clients. As the technological landscape rapidly evolves, we emphasize the importance of staying ahead of the curve. Partnering with us ensures your organization is ready to tackle current and future challenges. While the predicted “neon shortage” has been successfully averted, it doesn’t rule out the possibility of future disruptions due to global instabilities in the supply chain. By carefully evaluating future needs and the geopolitical climate, we can preemptively procure technology equipment when necessary, safeguarding your business or organization from potential supply chain instabilities. Don’t hesitate to contact LogicFortress today to ensure your business remains competitive and well-equipped in this ever-changing world.